Minimum Wage Trends in 2025 : A Comprehensive Global Overview

Why Is This Important?

Minimum Wages Around The World

Countries with higher living costs, such as the United States and Germany, generally establish higher minimum wages to ensure workers can afford basic necessities.

Luxembourg, with its finance- and technology-driven economy, offers a high minimum wage of approximately USD 2,711 per month for unskilled workers. In contrast, Vietnam, which relies on low-cost manufacturing as part of its “China Plus One” strategy, has a regional minimum wage ranging from USD 151 to USD 194 per month.

France, with its strong tradition of labour unions advocating for higher wages, sets a minimum salary of USD 1,851 per month. In the Philippines, where union influence is comparatively weaker, the minimum wage ranges between USD 169 and USD 231 per month, depending on the region.

For distinct reasons, Switzerland and Ethiopia are examples of countries without a national minimum wage. Switzerland relies on collective bargaining and economic flexibility, making a national minimum unnecessary, whereas in Ethiopia, where over 80% of the workforce is employed informally in agriculture and street vending, introducing a national minimum wage could lead to higher unemployment and increased labour costs.

Regional Insights

To comprehensively compare minimum wage levels across the globe, we have categorised the data based on continents. This allows us to observe significant regional differences and clarify how minimum wages vary according to local economic conditions, labour market policies, and cost of living.

- Europe: Minimum wages tend to be higher, particularly in wealthier nations such as Luxembourg, the United Kingdom and the Netherlands. These countries set minimum wage rules to ensure workers meet basic living expenses in their high-cost economies.

- North America: The United States and Canada also have relatively high minimum wages, though the range varies widely within each country. The U.S. has different wage standards by state, while Canada has a progressive wage scale across provinces.

- Asia: Minimum wages starkly contrast between advanced economies (such as South Korea) and developing nations, like Indonesia and India. The variation is due to differing economic structures – with more developed countries offering higher wages, for workers to keep up with living standards.

- Australia and New Zealand: Both countries feature relatively high minimum wages, reflecting their higher living costs and strong labour protections.

- South America: Minimum wages in South America tend to be lower than other continents. Countries like Brazil and Argentina have minimum wages that are significantly lower than those in Europe or North America. However, these wages are still adjusted to meet the economic context of the region.

- Africa: African countries such as South Africa have minimum wages that are comparatively low, especially when compared to more developed regions, reflecting the economic challenges faced in many parts of the continent.

Global Minimum Wage Comparison by Country and Continent :

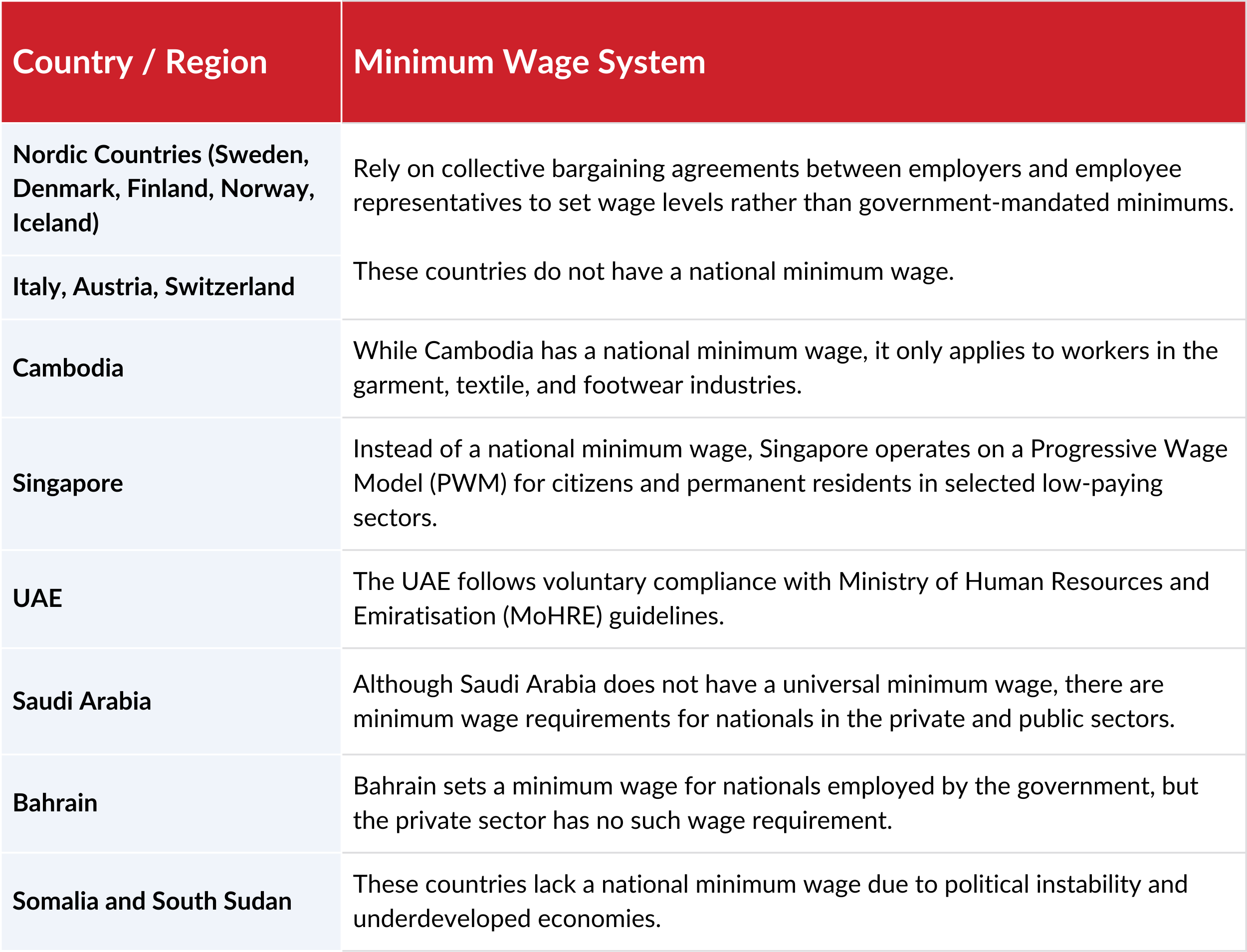

Countries Without a Statutory Minimum Wage

How Galaxy Payroll Can Help?

Disclaimer: This blog is for informational purposes only and does not constitute any legal advice.

Ready to Expand Your Business Globally?

Effortlessly expand your business globally with us, ensuring compliance, seamless hiring, and hassle-free payroll management.

FAQ’S

What is minimum wage, and why is it important for employers?

Minimum wage is the lowest hourly, daily, or monthly salary that employers must pay their employees to ensure access to basic necessities and protection against exploitation. It is a legal mandate by the government binding employers to commit to minimum wages as fixed under the statute for work performed during a given period. Minimum wage rates can vary significantly based on location (country, state or region) and sometimes even by industry or occupation. For global employers, understanding minimum wage ensures compliance with labour laws, prevents legal penalties, and promotes fair employee compensation.

How does the minimum wage vary across countries in 2025?

Minimum wages differ significantly by country and even by region within a country due to various factors affecting each region, such as inflation, economic conditions and labour policies. Employers should check the latest local regulations before fixing salaries.

Which countries have the highest minimum wages in 2025?

As of 2025, countries with the highest minimum wages include Luxembourg, Netherlands, Australia, New Zealand, United Kingdom, Ireland, Germany, France, etc. with Luxembourg paying the highest at US $ 2711 to US $3254 per month. However, the exact figures vary due to exchange rates, cost of living and government policies.

Which countries have the lowest minimum wages globally in 2025?

Cambodia, Sudan, Burundi, Rwanda, Georgia, Eswatini, Gambia, Guinea-Bissau, Kyrgyzstan, Uganda, Ghana, Nigeria and Madagascar are some of the countries that have lower minimum wages.

How often do governments adjust minimum wages?

Governments typically review and adjust minimum wages annually, but some make changes more frequently based on inflation or economic crises. Employers should stay updated on local labour laws to ensure compliance.

What penalties can employers face for non-compliance with minimum wage laws?

Failure to comply with minimum wage laws can result in fines, legal action, back payments to employees, and reputational damage. In some jurisdictions, repeat violations can lead to business license revocations.

Can businesses pay employees below the minimum wage under any circumstances?

Certain exceptions such as internships, apprenticeships, or training periods where lower wages are permitted, may apply. However, these exemptions vary by country and should be reviewed carefully.

How can global employers stay updated on changing minimum wages?

Employers can monitor government labour websites, consult local legal experts, or use compliance management services to stay informed about wage updates and regulatory changes.

Are there additional costs beyond minimum wages that employers should consider?

Yes, employers must account for payroll taxes, social security contributions, healthcare and other employee benefits. These elements can significantly impact total labour costs in different countries.

What role do labour unions play in determining minimum wages?

In many countries, labour unions negotiate minimum wage levels through collective bargaining, often resulting in industry-specific wage agreements that employers must follow.