Singapore Budget 2025 : Building a Future-Ready Workforce

“Every Singaporean is supported from birth to old age, with more given to those with less. No one is left behind.” said Prime Minister Lawrence Wong, during his Budget Speech 2025, rightfully describing the essence of the budget.

Sixty years, a relatively short period for a country (by any means), yet the ‘Little Red Dot’ island that is known as Singapore, was able to mark an impactful presence on the global stage – bolstering it’s strong economy from year to year for over half a century. Underpinned by it’s robust economic policies and deep pool of a skilled workforce, Singapore has in many ways, ticked the critical checkboxes to attract foreign direct investment and high quality skilled workers from across the globe.

Unlike previous years, where the focus leaned heavily on pandemic recovery, digital transformation, and global competitiveness, this year’s Singapore Budget 2025 signals a shift toward long-term workforce resilience and adaptability.

Let’s uncover what this budget has in store for employers and employees in Singapore.

Table Of Content

- The Singapore Budget 2025 Highlights:

- Supporting Skills Development and Lifelong Learning

- Increased Support for Part-Time Training and Workers with Lower Incomes

- Workforce Transformation and Employer Support

- Accelerating Inclusivity for Older Workers and Persons with Disabilities

- Fostering Work-Life Balance and Supporting Families

- Embracing Digital Transformation in HR

- Financial Support and Tax Incentives for Businesses

- Preparing for Future Challenges

- Conclusion: A Budget for the People and the Workforce

The Singapore Budget 2025 Highlights:

Supporting Skills Development and Lifelong Learning

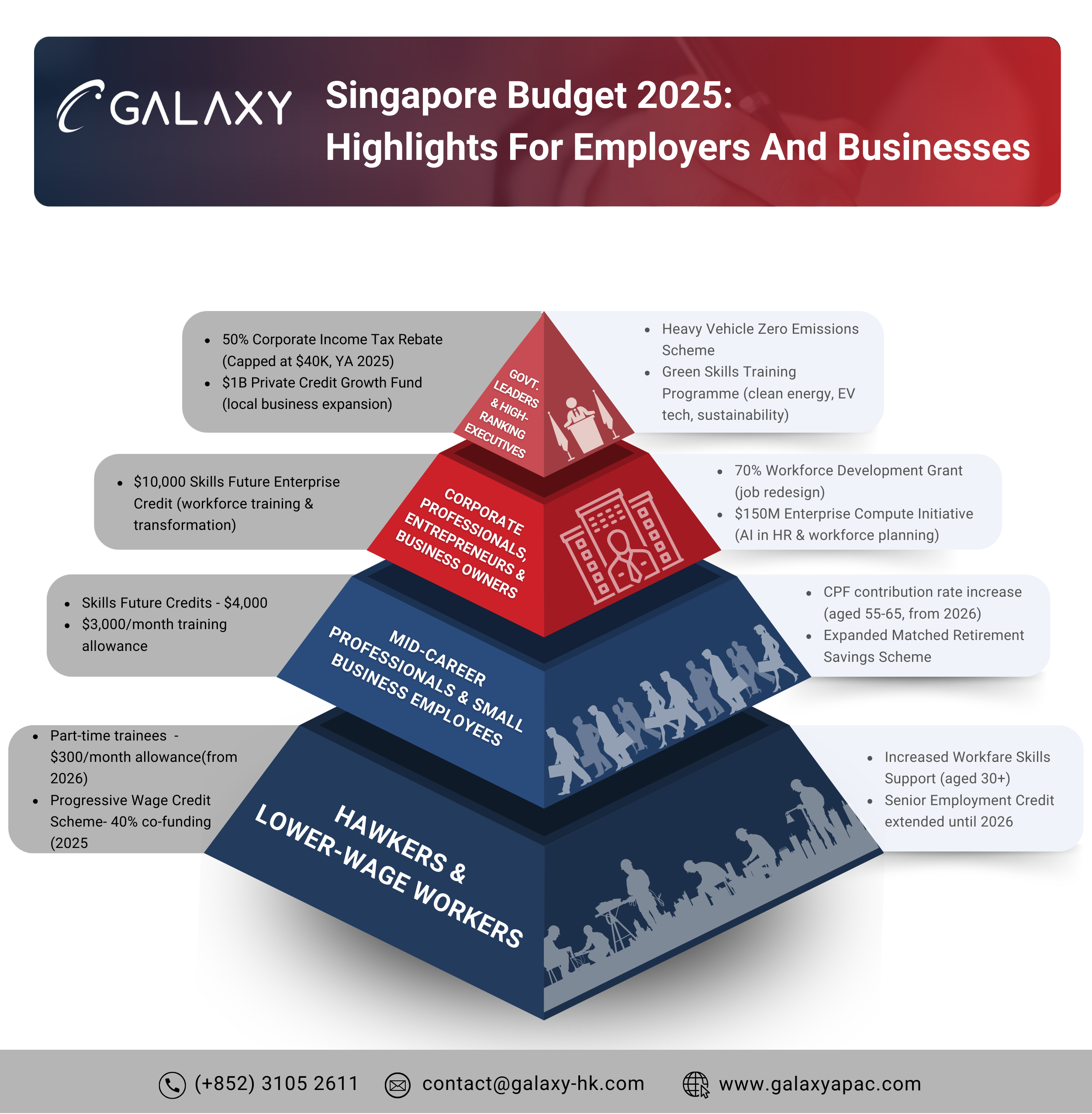

The Singapore government acknowledges that mid-career individuals face challenges in an evolving economic landscape, marked by rapid technological advancements and shifting job markets. Therefore, it is apparent that a focus is afforded on skills development and upgrade, especially for workers aged 40 and above.

The government is committed to grant $4,000 to all Singaporeans of this age group, in SkillsFuture credits and a monthly training allowance of up to $3,000 for selected full-time courses. This scheme will be supported for up to 24 months; prioritizing lifelong learning and ensuring that Singapore employees are always equipped to meet the demands of evolving industries.

Increased Support for Part-Time Training and Workers with Lower Incomes

Taking care of the wage gap, Singapore Budget 2025 allocates a $300 monthly allowance to part-time trainees from 2026, ensuring that workers not only have the opportunity to upskill but are also supported financially while they do so.

This will enhance the Workfare Skills Support Scheme and Progressive Wage Credit Scheme to provide additional support for lower-wage workers who are over the age of 30. There will be an increase in co-funding from 30% to 40% in 2025 and from 15% to 20% in 2026. With the additional support, businesses will be more encouraged to invest in skills upgrades for their workforce, regardless of age or wage level.

Workforce Transformation and Employer Support

A more comprehensive set of incentives for employers focused on workforce transformation under the revamped SkillsFuture Enterprise Credit program. This enhanced set of incentives will access businesses (with three or more resident employees) to at least $10,000 in credits, which can be used offset costs associated with employee training and enterprise transformation.

To ensure that businesses are able to manage their workforce programmes efficiently, a new online wallet system has been introduced, allowing companies to track available credits and use status – thus reducing delays in funding.

Furthermore, to help companies modernize their workforce to align with new technological advancements, the Workforce Development Grant offers up to 70% funding for job re-design activities.

Accelerating Inclusivity for Older Workers and Persons with Disabilities

Aging populations are always important concerns for governments worldwide. Therefore, it is equally important for governments to recognise that an inclusive workforce that supports older employees, is critical for a robust and resilient economy.

In view of this, the Singapore government has announced that the Senior Employment Credit will be extended until the end of 2026. This will continue to provide wage support for older Singaporean workers aged 69 and above – alongside an increase in the CPF contribution rate for workers aged 55-65 in 2026.

By increasing financial support through expanded subsidy rates for adult disability services and the Matched Retirement Savings Scheme, the Budget justifies its title – Onward Together For A Better Tomorrow.

The Singapore Government will also continue working with organizations like SG Enable and the Special Needs Trust Company to encourage long-term financial planning for caregivers of persons with disabilities.

Fostering Work-Life Balance and Supporting Families

Singapore Budget 2025 acknowledges the value of work-life balance by including provisions that directly benefit working families.

By introducing Large Families Scheme, where families with three or more children will receive upgraded financial support, will make it easier for parents to remain in the workforce whilst raising a family. The scheme includes a $5,000 increase in the Child Development Account (CDA) First Step Grant and $1,000 in LifeSG credits for each child in the family.

Embracing Digital Transformation in HR

Technology plays a key role in the workforce development journey. Strategically, the Enterprise Compute Initiative will provide $150 million to support AI adoption. Businesses can engage with cloud service providers and AI experts, to help HR professionals stay ahead of the digital curve. It is anticipated that AI adoption and maturity will better equip Singaporean HR professionals to address challenges, such as talent shortage and employee expectations.

With initiatives such as the Digital Economy Council and the Smart Nation Digital Government Group, the Government ensures that businesses align with Singapore’s commitment to being a Smart Nation.

Financial Support and Tax Incentives for Businesses

Singapore will continue to encourage investment in local enterprises through the $1 billion Private Credit Growth Fund, which will make it easier for expanding businesses to invest in development initiatives for their employees.

A 50% corporate income tax rebate for the Year of Assessment 2025, with a cap of $40,000 is a very encouraging move for businesses who qualify for the rebate.

Preparing for Future Challenges

Singapore Budget 2025, has forward-looking policies like the Heavy Vehicle Zero Emissions Scheme, which will address external challenges such as climate change, technological disruption and volatile global markets. The scheme will help businesses remain competitive and resilient in the face of new challenges.

In line with the Singapore Green Plan 2030, the introduction of the Green Skills Training Programme will provides targeted training to workers in key sectors such as clean energy, electric vehicle technologies and environmental sustainability. The intent for this programme is to boost the green economy and creation of more green jobs for Singaporeans.

Conclusion: A Budget for the People and the Workforce

Singapore Budget 2025 introduces a refreshed push in Singapore’s journey towards a more inclusive and resilient future. All the initiatives and programmes underscore the government’s commitment to ensuring that every Singaporean worker has the support, opportunities, and resources they need to succeed.

With a focus on workforce development and skills upgrade, Singapore Budget 2025 aims to tie Singaporeans of all backgrounds with the country’s vision for continued economic growth and stability.

Prime Minister Lawrence Wong’s words of “Every Individual Action Counts”, demonstrates the level of commitment required by the Government and all Singaporeans, towards establishing a thriving future for generations of Singaporeans to come.

Our Quick Guide on Effective Taxation & Tax Planning Strategies for Businesses in Hong Kong

Derive the Maximum Benefits from Singapore Budget 2025!

Expand into Singapore With Galaxy Payroll Group!

FAQ’S

What are the key initiatives in Singapore Budget 2025?

- The government continues to help Singaporeans cushion higher costs of living with a series of vouchers, rebates and credits schemes. This will be disbursed from May 2025 to January 2026.

- Workers are encouraged to upskill with the introduction of new measures. Singapore Budget 2025 continues to build on the nationwide emphasis of helping Singaporeans to retrain or reskill.

- With Singapore Budget 2025, more help has been afforded to working parents who are managing costs associated with raising children in Singapore.

How does Budget 2025 support employee training and skills development?

The Government has expanded the SkillsFuture Enterprise Credit Scheme to help companies fund training programs in high-demand sectors such as AI, data analytics and green technology. There are also sector-specific training programmes to prepare workers for evolving job demands.

What initiatives are there to promote work-life balance for working families?

The Budget acknowledges the value of work-life balance by including provisions that directly benefit working families. Schemes like the Large Families Scheme and Child Development Account (CDA), will help working parents who are raising families.