Should a Small Business Outsource its Payroll Function?

Effective payroll management is a fundamental requirement for any organisation committed to operational excellence and regulatory compliance. For small and medium-sized enterprises (SMEs), however, maintaining accuracy and adherence to ever-evolving tax laws can place a considerable strain on internal resources, particularly as businesses expand into new markets and adopt flexible, remote working models.

In this context, outsourcing payroll has become an increasingly strategic consideration rather than a mere administrative choice. By entrusting this critical function to a reputable specialist, organisations can mitigate compliance risks, safeguard sensitive employee information, and redirect valuable time and effort toward core business objectives.

This article outlines the concept of payroll outsourcing and examines its principal benefits and potential challenges.

Read Our Blog: Payroll Outsourcing: A Cost-Effective Solution For Employers

Table Of Content

- What is Payroll Outsourcing?

- Why Payroll Outsourcing is on the Rise?

- Key Advantages of Payroll Outsourcing

- Potential Drawbacks to Consider

- How Payroll Outsourcing Works?

- Essential Features of a Trusted Payroll Provider

- When Should Small Businesses Consider Outsourcing Payroll?

- In-House Payroll vs Outsourced Payroll

- Conclusion

What is Payroll Outsourcing?

Payroll outsourcing involves engaging a qualified third-party provider to manage all payroll-related tasks for your organisation. Unlike general HR outsourcing – which may include recruitment and employee relations – payroll outsourcing focuses exclusively on ensuring employees are paid accurately and on time, in strict compliance with applicable laws.

A reputable payroll provider typically:

- Calculates wages, taxes, and statutory deductions accurately

- Disburses salaries promptly through secure payment channels

- Prepares and files all mandatory tax documents

- Maintains secure records and ensures compliance with local and international regulations

For small businesses expanding into new markets or managing a distributed workforce, outsourcing payroll to a specialist with expertise in global payroll can substantially reduce administrative burdens and legal exposure.

Modern business dynamics have introduced payroll challenges to small businesses that previously were encountered only by large organisations. With more companies hiring remote teams and managing cross-border operations, ensuring compliance, accuracy, and timeliness in payroll has become increasingly demanding.

Recent industry reports indicate that over 70% of organisations now outsource some or all payroll processes, primarily to:

- Minimise Compliance Risk: Expert providers help avoid costly errors in tax reporting or employee classification.

- Reduce Administrative Load: Outsourcing frees owners and managers to focus on high-value priorities.

- Improve Accuracy: Professional payroll systems significantly reduce manual errors, a leading cause of pay discrepancies.

Key Advantages of Payroll Outsourcing

The advantages of payroll outsourcing extend significantly beyond routine payslip processing; with the support of a reliable payroll partner, organisations benefit from enhanced regulatory compliance, cost efficiency, operational scalability, robust data security, and the ability to redeploy internal resources toward higher-value strategic initiatives.

1. Strengthened Compliance

Outsourcing ensures that your payroll complies with the latest tax legislation, statutory contributions, and employment regulations relevant to your jurisdiction.

2. Controlled Costs

While outsourcing involves service fees, it can prove more cost-effective than hiring, training, and retaining in-house payroll staff or investing in and maintaining advanced payroll software.

3. Scalability

An outsourced solution can adjust seamlessly as your headcount changes, making it ideal for businesses planning to expand or hire internationally.

4. Data Security

Professional providers invest in sophisticated security systems and encrypted portals, protecting confidential employee information and reducing the risk of internal fraud.

5. Focus on Core Business

By delegating time-intensive payroll administration to experts, leaders can devote greater attention to strategic tasks that drive revenue and improve customer service.

Potential Drawbacks to Consider

While outsourcing payroll offers clear benefits, it may not suit every organisation. Common concerns include:

Reduced Direct Control: Some businesses prefer to retain internal management of sensitive payroll data.

Dependency on the Provider: The quality and security of your payroll depend on the provider’s systems and governance.

Service Costs: For very small teams, simple payroll software may suffice, but this shifts the compliance responsibility back to internal staff.

How Payroll Outsourcing Works?

While each provider may follow slightly different procedures, the overall process of outsourcing payroll generally adheres to a straightforward, well-defined workflow. This structured approach ensures that payroll is handled accurately, securely, and fully compliant with applicable regulations, allowing businesses to maintain oversight while minimising administrative burden.

A typical payroll outsourcing process includes the following stages:

- Initial Onboarding:

The provider collects and reviews the organisation’s existing payroll data, employee records, contracts, and relevant compliance documentation to establish a secure foundation.

- Secure Data Submission:

For each pay period, the company submits updated information – such as salary adjustments, hours worked, new hires, or terminations – through secure channels.

- Payroll Calculation and Processing:

The provider calculates gross earnings, applies the appropriate statutory deductions and benefits, and prepares payslips for all employees.

- Payment Distribution:

Employee salaries are disbursed accurately and on time via secure bank transfers or other approved payment methods.

- Tax Filing and Regulatory Reporting:

All mandatory tax submissions and statutory reports are prepared and filed in accordance with local deadlines and compliance requirements.

- Reporting and Support:

The organisation receives detailed payroll reports, dashboards, and audit trails to maintain oversight and support informed financial decision-making.

Essential Qualities of a Trusted Payroll Provider

Not all providers offer the same level of service. Look for payroll partners who provide:

- Automated, error-free payroll runs

- End-to-end tax filing support, locally and internationally

- Employee self-service portals for payslips and tax documents

- Active compliance monitoring and timely regulatory updates

- Secure, encrypted data storage and user authentication.

- Integration with your accounting and HR systems

- Responsive, knowledgeable client support

When Should Small Businesses Consider Outsourcing Payroll?

Outsourcing payroll is often the best choice when:

- Your team is expanding or working across multiple regions

- Internal staff struggle to keep pace with changing regulations

- Payroll administration consumes significant time and focus

- You need robust data security and fraud mitigation

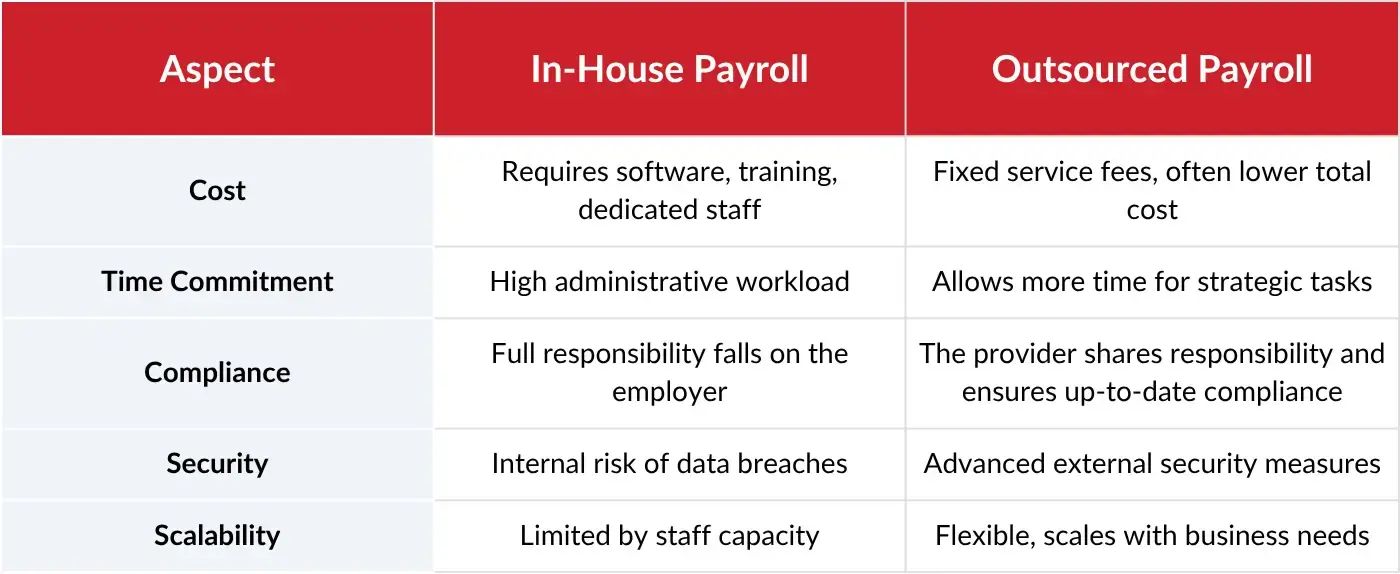

In-House Payroll vs Outsourced Payroll

Choosing between managing payroll internally and engaging a specialist provider is a decision that affects costs, compliance, and operational efficiency. For small businesses weighing the two options, it is crucial to understand how they differ in practice.

The following table provides a clear overview of the key distinctions, helping you evaluate which approach best aligns with your company’s resources, risk appetite, and growth ambitions.

Conclusion

For many small businesses, outsourcing payroll is not simply an operational convenience – it is a strategic move that enhances accuracy, compliance, and financial predictability in a complex regulatory environment. By entrusting payroll to experienced professionals, companies minimise legal risks, protect sensitive data, and unlock time to focus on growth and customer value.

However, the benefits depend greatly on partnering with a provider who understands your industry, region, and workforce needs. The right partner brings secure technology, regulatory expertise, and tailored solutions that scale with your ambitions.

For businesses seeking reliable payroll solutions in Singapore, Hong Kong, and Asia-Pacific, Galaxy Group combines local insight with global best practices to ensure your payroll is managed accurately and securely, giving you complete peace of mind to focus on what matters most: your success.

Switch to Stress-Free Payroll Solutions

Contact Galaxy Payroll Group today and discover how our trusted payroll solutions can free your business to focus on what matters most.

FAQ’S

What exactly is payroll outsourcing?

Payroll outsourcing involves engaging an external provider to handle all aspects of employee pay, including wage calculations, statutory deductions, tax filings, and payslip distribution. Unlike general HR outsourcing, this service ensures employees are paid accurately and complies with local laws.

How do outsourced payroll services usually work?

A payroll outsourcing provider typically takes over the routine but complex tasks involved in payroll. This includes gathering employee pay data, processing salaries, calculating taxes and deductions, arranging payments to staff and tax authorities, and preparing detailed reports for the employer. Many providers offer secure online portals so employers can monitor payroll activity anytime.

What types of payroll outsourcing services are available?

Businesses can choose from

- Full-service payroll providers manage the entire payroll cycle and compliance.

- Professional Employer Organisations (PEOs) handle payroll alongside HR functions such as benefits and risk management.

- Employer of Record (EOR) services, which legally employ staff on your behalf in overseas markets, ensuring full compliance.

- Payroll software, which is technically self-managed, automates many payroll calculations.

How does payroll outsourcing help with tax compliance?

A qualified payroll partner keeps current with national and regional tax requirements, ensuring accurate calculations, timely tax payments, and correct filing of year-end returns. This dramatically reduces the risk of penalties or audits.

Will I still have access to payroll information if I outsource?

Yes. Reputable providers supply secure online dashboards where you can check payroll records, payment histories, and compliance documents anytime.

Are there any risks in outsourcing payroll?

Potential risks include sharing sensitive employee data with a third party and losing some internal control over pay processes. However, partnering with a trusted, certified provider with robust data protection measures significantly reduces these concerns.

Is payroll outsourcing more cost-effective than doing it in-house?

In many cases, yes. Outsourcing removes the need for specialist payroll staff, expensive software licences, and time-consuming compliance work. For growing businesses, this can deliver substantial savings over time.

What is the difference between payroll outsourcing and using payroll software?

Payroll software automates calculations but requires your team to input data, check accuracy, and stay on top of tax rules. By contrast, outsourcing hands the entire process to external experts, providing peace of mind that payroll is run correctly and on time, with minimal effort from your in-house staff.