A Comprehensive Guide to Work Permits in Hong Kong: Eligibility, Essentials, and Key Insights

In an era of global talent mobility, businesses are increasingly expanding their operations beyond domestic markets to access the skills and expertise needed to stay competitive. Hong Kong, with its established position as a gateway to Asia, continues to be a preferred destination for companies seeking to recruit international professionals.

Renowned for its business-friendly regulatory environment, robust legal system, and strategic proximity to regional markets, Hong Kong attracts organisations across financial services, technology, healthcare, logistics, and more. However, while the jurisdiction offers a favourable operating landscape, employing non-local talent requires careful navigation of its immigration framework.

To support this demand, the Hong Kong government has implemented a range of work permit and visa schemes, each tailored to different workforce needs—from experienced professionals and recent graduates to trainees and sector-specific workers. Understanding the distinctions between these schemes is critical to ensuring compliance, avoiding delays, and enabling a smooth onboarding process.

In this article, Galaxy Group offers a structured overview of the available work permits in Hong Kong, highlighting eligibility criteria, key distinctions, and strategic considerations for employers managing cross-border recruitment.

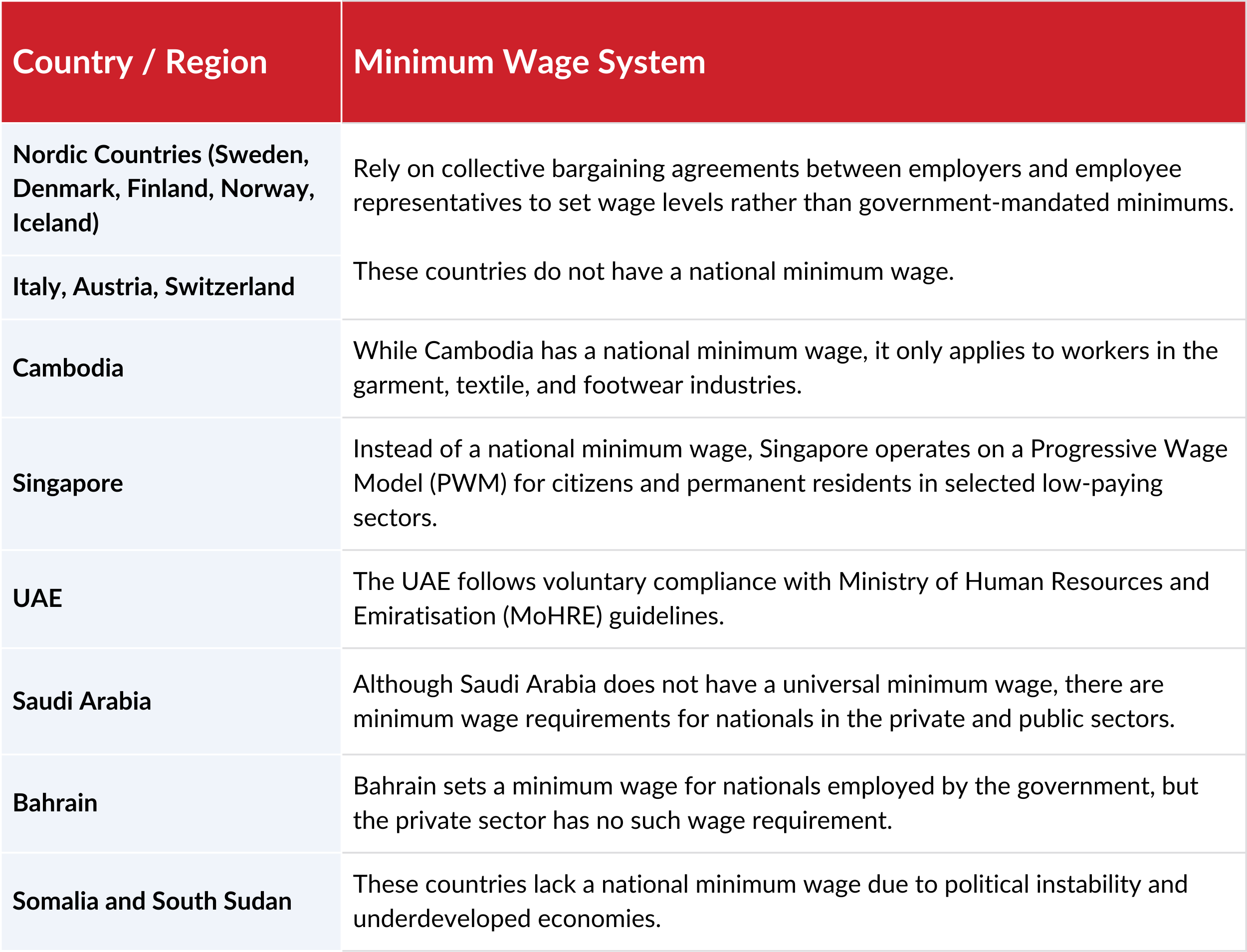

Description Of Various Work Permit Schemes Specifying Overview, Basic Eligibility Criteria And Notes

Conclusion

Hiring international talent in Hong Kong requires a clear understanding of the territory’s visa framework and a careful approach to compliance. For many businesses, navigating this process independently can be time-consuming and administratively demanding.

Engaging a knowledgeable partner with regional expertise can ease this burden, ensuring applications are correctly structured, timelines are met, and regulatory risks are minimised. With the proper support, companies can focus on growth while ensuring their global workforce is onboarded efficiently and fully compliant.

Galaxy Group supports businesses across Asia with precisely this kind of operational clarity.

Read our Guide “Should You Opt For EOR Services: 5 Key Reasons” to know why you should hire an EOR.

Need guidance on hiring international talent in Hong Kong?

Partner with Galaxy to ease your work permit application process.

FAQ’S

What is the most common work permit in Hong Kong?

The General Employment Policy (GEP) is the most common work permit aimed at attracting professionals to work in sectors that contribute to Hong Kong’s economy not readily available in Hong Kong.

Can I bring my family with me on a work permit in Hong Kong?

Yes, most work permits allow dependents to apply for Dependent Visas, enabling them to reside and, in some cases, work or study in Hong Kong; however, one has to follow specific application process for the same.

How long does it take to process a work permit application in Hong Kong?

Applications typically take 4-6 weeks to process after all required documents are received, however the same varies from case to case. A longer processing time may be required during summer rush period between June and August.

Can work permit holders apply for permanent residency in Hong Kong?

Not in every case but many of them allow applying for permanent residency after seven years of continuous lawful residence in Hong Kong.

Are there any nationality restrictions for Hong Kong work permits?

Yes, most work permits are not available to nationals of Afghanistan, Cuba, and North Korea due to specific restrictions.