Exploring The Role That Payroll Strategies Can Play in Corporate Sustainability Initiatives

As global attention on environmental protection and social responsibility grows, businesses are increasingly recognising the importance of sustainability for long-term success. Many enterprises are making notable strides in this area. In this context, payroll services and strategies are a critical component of business management, and becoming closely integrated with the sustainability goals of their customers.

Table Of Content

The Benefits Of Effective Payroll Strategies for the Sustainability Agenda

Payroll strategies are not just essential for attracting and retaining talent; they are also a vital tool in driving a company’s sustainability initiatives. By designing and implementing compensation structures that align with sustainability objectives, companies can incentivise behaviors that contribute to environmental and social goals. For example, performance-based bonuses could be tied to metrics such as reducing carbon emissions, improving energy efficiency at work, or engaging in corporate community initiatives as part of our services.

Challenges and Opportunities

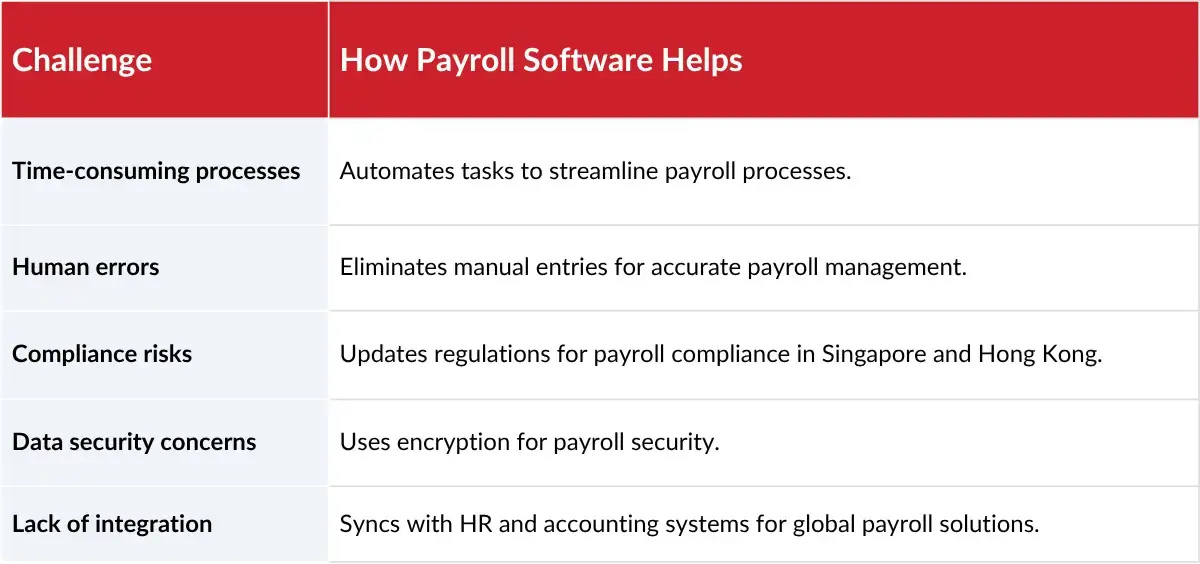

While the integration of payroll services and sustainability initiatives offers numerous benefits, it also presents challenges. One of the main challenges is the need for robust data collection and analysis systems to accurately measure and track the employee’s performance against his/her sustainability plan for the year. Additionally, companies must ensure that their compensation structures are fair and transparent, particularly when linking pay to sustainability-focused outcomes.

Conclusion

As businesses continue to embrace sustainability as an important company goal. Payroll services and strategies will increasingly be part of the toolkit that helps drive performance and results in this area. By integrating sustainability goals into payroll and compensation strategies, companies can drive meaningful change and contribute to a more sustainable future. The journey towards sustainability is complex, but with the right approach, businesses can achieve both financial success and positive environmental and social impact.