Should You Opt for EOR Services? Here are 5 Key Factors to Consider

In an increasingly interconnected world, businesses are expanding across borders to take advantage of potential markets and explore new talents. However, managing an international workforce comes with regulatory and administrative challenges, especially for businesses with limited access to or knowledge about new territories. This is where an Employer of Record (EOR) services plays a pivotal role.

Engaging an EOR not only simplifies global hiring but also removes the operational burden of managing employment compliance, payroll, and legal formalities in foreign countries.

However, finding a perfect EOR can be challenging and has certain limitations.

So, let’s explore core reasons why you should be engaging an employer of record and the disadvantages they come with.

5 Core Reasons Why You Should be Engaging an Employer of Record (EOR)?

Partnering with an EOR simplifies business processes, especially for international hiring. Let’s explore how engaging an EOR can advance business growth and efficiency.

1. Acceleration of Global Expansion Plans

An EOR allows businesses to expand into new markets without the need to establish a legal entity, shouldering the administrative and employment compliance burden. This initiative helps boost business outreach plans, enabling companies to channel their energies in other required areas.

2. Ease of Handling Legal Markets

Handling labour laws can be challenging due to significant variations in regulatory frameworks between countries. For example, France has strict labour laws mandating minimum severance pay and employee benefits, while Singapore offers more flexibility in employment contracts. An EOR ensures compliance with such local regulations as well as tax regulations, payroll processing, benefits administration, etc. allowing businesses to operate legally without establishing a physical presence and minimising the risk of legal issues for the company.

3. Facilitates Hiring:

(a) In No Time

With expertise in global hiring, EOR makes international staffing quick and easy through its connectivity network and simplified processes, which otherwise would be stringent and lengthy for any foreign company. For instance, in countries like Brazil, where obtaining a work permit can be a lengthy process, an EOR can simplify and expedite the onboarding of employees through an expert network of local partners. This ensures businesses secure skilled professionals, giving them a competitive edge in fast-paced markets.

(b) In Budget

Employers of Record (EORs) open access to global talent pools, allowing businesses to recruit skilled workers at competitive salaries. This is particularly advantageous for startups and SMEs aiming to maximise their hiring budgets.

(c) Equitably

By standardising payroll, benefits, and HR processes across borders, an EOR ensures that employees in different countries, such as India and Japan, enjoy equitable treatment despite varying local laws. This consistency enhances satisfaction and loyalty among global teams.

(d) Synergy

EOR aims to ensure that employees have a smooth, consistent, and positive experience across all stages of their employment, creating a stronger connection between the employee and the organisation. EORs employ tested and proven technologies or processes to effectively bring these different touchpoints together.

(e) Mobility

Relocating employees can be challenging, especially in countries with stringent visa requirements like the United States. An EOR takes charge of work permits and immigration paperwork, simplifying the process for businesses and employees.

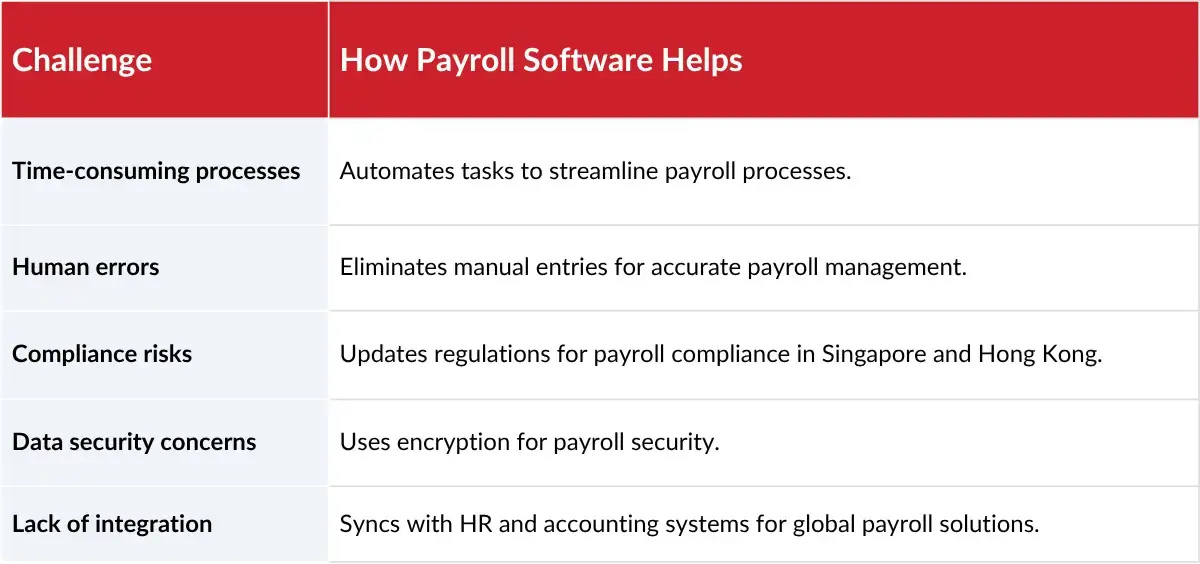

4. Cost Efficiency and Reduced Administrative Burden

Establishing a subsidiary in countries like Switzerland, known for its stringent regulatory frameworks, can be costly and time-intensive. An EOR provides a cost-effective alternative, allowing businesses to explore new markets without the heavy financial and operational commitments of setting up a local entity.

Moreover, EORs significantly reduce administrative burdens by managing essential tasks such as payroll processing, employment and regulatory compliance, benefits administration, and tax filings.

5. Avoids Employee Misclassification

Misclassifying employees as independent contractors can lead to fines and penalties in countries like Australia, France and Japan. An EOR eliminates this risk by ensuring correct classification under local laws. The EOR structures agreements for contractors to align with independent contractor laws, avoiding practices that could reclassify them as employees, such as controlling their work schedules and providing benefits.

In an increasingly interconnected world, businesses are expanding across borders to exploit potential markets and explore a wider pool of skilled workers. However, the regulatory and administrative complexities of managing a workforce in foreign countries can be challenging for those needing more access to and knowledge about new territories. This is where an Employer of Record (EOR) plays a significant role.

The Cons of Hiring an EOR

Having an Employer of Record (EOR) with you has numerous benefits, but at the same time, one might face certain limitations. So, let’s dive into possible disadvantages associated with hiring an EOR:

1. Lack of Control

Since the EOR becomes the legal employer, businesses might lack direct control over employment-related decisions. Heavy reliance on a third-party service provider also carries inherent risks if the EOR underperforms or fails to meet its obligations.

2. Complexity in Large-Scale Operations

Managing a workforce through an EOR across multiple countries, such as India, Australia and the UK, can create operational complexities. Ensuring consistency in employee policies and practices may become challenging as the scale grows if the EOR is not competent enough to manage large-scale international engagements. Choosing a competent EOR for international employee engagements is critical for success.

3. Employee Perception Issues

Employees may perceive the EOR as a barrier between them and the Company. In countries like Germany, where employment stability is highly valued, such perceptions could impact morale and loyalty. It is thus important that an adequate EOR equipped with best-of-class employee interaction practices is chosen for the undertaking.

4. Data Protection and Legal Disputes

Sharing sensitive employee data with a third party can raise concerns about privacy and protection. Additionally, disputes between the EOR and the company may lead to legal complications. These areas must be clearly stated and agreed upon in the Master Services Agreement to ensure that such lapses do not occur.

Conclusion

Although an EOR can extremely benefit businesses, companies might have to face certain hiring limitations. Therefore, before partnering, one must conduct rigorous due diligence and enquiry about the EOR to find the suitable one that can understand and satisfy the Company’s expectations.

Businesses should evaluate their operational needs, workforce size, and long-term goals. Tailoring the partnership to align with these factors can help maximise the benefits while minimising the risks. For companies eager to explore global markets, an EOR offers a flexible and cost-effective solution to handle the complexities of international employment.

Make Galaxy Payroll Group your trusted partner for global expansion offering world class HR excellence and corporate solutions across the Asia Pacific region today!

Searching for a suitable EOR for your business?

Partner with Galaxy – the leading HR Excellence and Business Advisory Services in Asia Pacific with 30+ years of experience!!

FAQ’S

1. Why should I engage an EOR?

One should engage an EOR to energise business expansion plans. By transferring the administrative burden of employment compliance in a foreign country, you will be able to focus on the core business operations.

2. Are there any risks of engaging an EOR?

Yes, underperformance by an EOR is a potential risk. Do ensure that the provider has a presence in the target country, deep knowledge of local employment nuance, expertise in managing an international workforce, and service offerings aligned with your business needs.

3. How do I choose the right EOR?

The right EOR (employer of record) must have good experience in hiring and managing employees as well as expertise in labour law compliances. It’s service and cost offerings must match your budget and business needs.